a. Out-of-network liability and balance billing

Out-of-network provider: An out-of-network provider is any provider that does not have a preferred provider agreement with Blue KC. Depending on the plan, services from an out-of-network provider may or may not be covered. PPO members who visit an out-of-network provider usually receive limited benefits. It is important to know not all out-of-network providers are the same. Some have agreed to accept the Blue KC allowable charge when billing the patient. Nonparticipating out-of-network providers can bill any amount, and the member may be responsible for those charges.

Balance Billing: The bill that a provider sends to a member for charges that exceed the allowable charge. For healthcare services obtained from a non-contracted provider, the member may have to pay bill amounts above the allowable charge. If covered emergency services are provided by an out-of-network provider or provided outside of our service area, such services will be provided at the in-network benefit level.

If You receive care from an Out-of-Network Provider that is Non-Participating, it will be Your responsibility to make payment arrangements with the facility. Some of these Providers will submit Your Claim for You. If not, You can obtain a Claim form from Us. You can do so by calling the telephone number listed on Your ID card. The form will give You instructions for filing the Claim.

b. Enrollee claims submission

Usually your provider will file claims for you. Special circumstances may occur that require you to submit a claim, such as emergency room services, ambulance services, or an out-of-network provider.

If you do need to submit a claim you will need a Blue KC claim form.

If you are located in the Kansas City area, send to Blue Cross and Blue Shield of Kansas City, PO Box 419163, Kansas City, MO 64141-6169. If you are located outside of the Kansas City area, please call the customer service phone number located on your ID card or 816-395-3558 to obtain the address for the nearest BCBS office.

Claims should be filed throughout the year as warranted by expenses, but must be filed within 365 days after the end of the calendar year in which the service is received.

c. Grace periods and claims pending policies during the grace period

A grace period is also known as a delinquency period. Blue KC provides a 90-day grace period to any member with a premium tax credit (subsidy). Payment must be received in full for the month, by the end of the month or the member will go into delinquency. The member must pay all premiums due in full within 90 days in order to keep the policy active.

When a member enters the delinquency period, Blue KC continues to pay claims for that first month. Any claims received during the second or third month of delinquency are pended (not paid), until payment is received in full and the member is out of delinquency. If the member pays in full and is no longer delinquent, claims process as normal. However, if payment is not received, the claims may be denied, and the member is responsible for payment to the provider.

d. Retroactive denials

A retroactive denial is the reversal of a previously paid claim, through which the member then becomes responsible for payment.

Claims can be denied retroactively, even after the member has obtained services from the provider, if applicable.

There are ways to prevent retroactive denials:

- Make premium payments on time.

- Discontinue using your Blue KC ID card when you know your policy is not active, or if you’ve gone into delinquency.

- Notify providers and pharmacies of new coverage, if applicable.

Sometimes our members need access to drugs that are not listed on the Blue KC’s formulary (drug list). These medications are initially reviewed by Blue KC through the formulary exception review process. The member or provider can submit the request to us by faxing the Pharmacy Formulary Exception Request form. If the drug is denied, you have the right to an external review.

Members, members’ representatives, or prescribing providers can contact the Blue KC Appeals Department should they feel we have denied the non-formulary request incorrectly:

Blue KC Appeals Department

P.O. Box 417005

Kansas City, MO 64179-9773

Fax: 816-278-1920

For standard exception review of medical requests where the request was denied, the timeframe for review is 72 hours from when we receive the request. For expedited exception review requests where the request was denied, the timeframe for review is 24 hours from when we receive the request.

To request an expedited review for exigent circumstance, select the “Request for Expedited Review” option in the Request Form.

e. Enrollee recoupment of overpayments

If a member has paid more than the amount due during any given period, Blue KC will apply those funds to a future premium bill. If the member would prefer a refund, that can be done by calling customer service at the phone number listed on their Blue KC member ID card.

f. Medical necessity and prior authorization timeframes and enrollee responsibilities

Prior Authorization—a review of elective inpatient admissions and selected outpatient procedures conducted by Blue KC along with your physician, prior to the service to ensure you are receiving the most appropriate care. Some categories of drugs also require prior authorization. A list of services and medications that require prior authorization can be found in the Get Care section of MyBlueKC.com. Please be aware that Blue KC employees are not compensated for conducting reviews based on denials of coverage.

Prior authorization requests must be received prior to the procedure being done, and may take up to 36 hours (to include one business day) to process.

If prior authorization is not received for procedures that require prior authorization, the member may be liable for the cost of the procedure.

g. Drug exceptions timeframes and enrollee responsibilities

Blue KC maintains an open formulary (also referred to as a prescription drug list [PDL]). While this means members have access to FDA approved drugs according to their benefits, there may be some restrictions in place before you can use your benefits to receive a higher-tiered drug. Some of these medications will require you to first try a medication that is proven to be safe and effective for treating your condition/symptoms but at a lower cost. If the lower-cost medication doesn’t work for you (your symptoms persist, unwanted side effects, allergy, etc.), you should contact your doctor, who can submit a prior authorization request to Blue KC for the higher-tiered drug. This request will be answered within 36 hours to include one business day.

Sometimes our members need access to drugs that are not listed on the plan’s formulary (drug list). These medications are initially reviewed by Blue KC through the formulary exception review process. The member or provider can submit the request to us by faxing the Pharmacy Formulary Exception Request form. If the drug is denied, you have the right to an external review. If you feel we have denied the non-formulary request incorrectly, you may ask us to submit the case for an external review by an impartial, third-party reviewer known as an independent review organization (IRO). We must follow the IRO’s decision. An IRO review may be requested by a member, member’s representative, or prescribing provider by mailing, calling, or faxing the request:

Blue KC Appeals Department

P.O. Box 417005

Kansas City, MO 64179-9773

Fax: 816-278-1920

For initial standard exception review of medical requests, the timeframe for review is 36 hours from when we receive the request. For initial expedited exception review of medical requests, the timeframe for review is 24 hours from when we receive the request. For external review of standard exception requests that were initially denied, the timeframe for review is 72 hours from when we receive the request. For external review of expedited exception requests that were initially denied, the timeframe for review is 24 hours from when we receive the request. To request an expedited review for exigent circumstance, select the “Request for Expedited Review” option in the Request Form.

h. Understanding Your EOB

When you visit a doctor or hospital, they work with Blue KC to file a claim on your behalf. These claims are outlined on your EOB. It’s your go-to reference for important information like how much of your care was covered and how much you may still need to pay.

EOBs are generated after a claim is received and adjudication is complete. For real-time information on your benefits and to view a digital copy of your EOB(s), log in to your Blue KC member portal. Paper copies of EOBs are mailed on a weekly cycle.

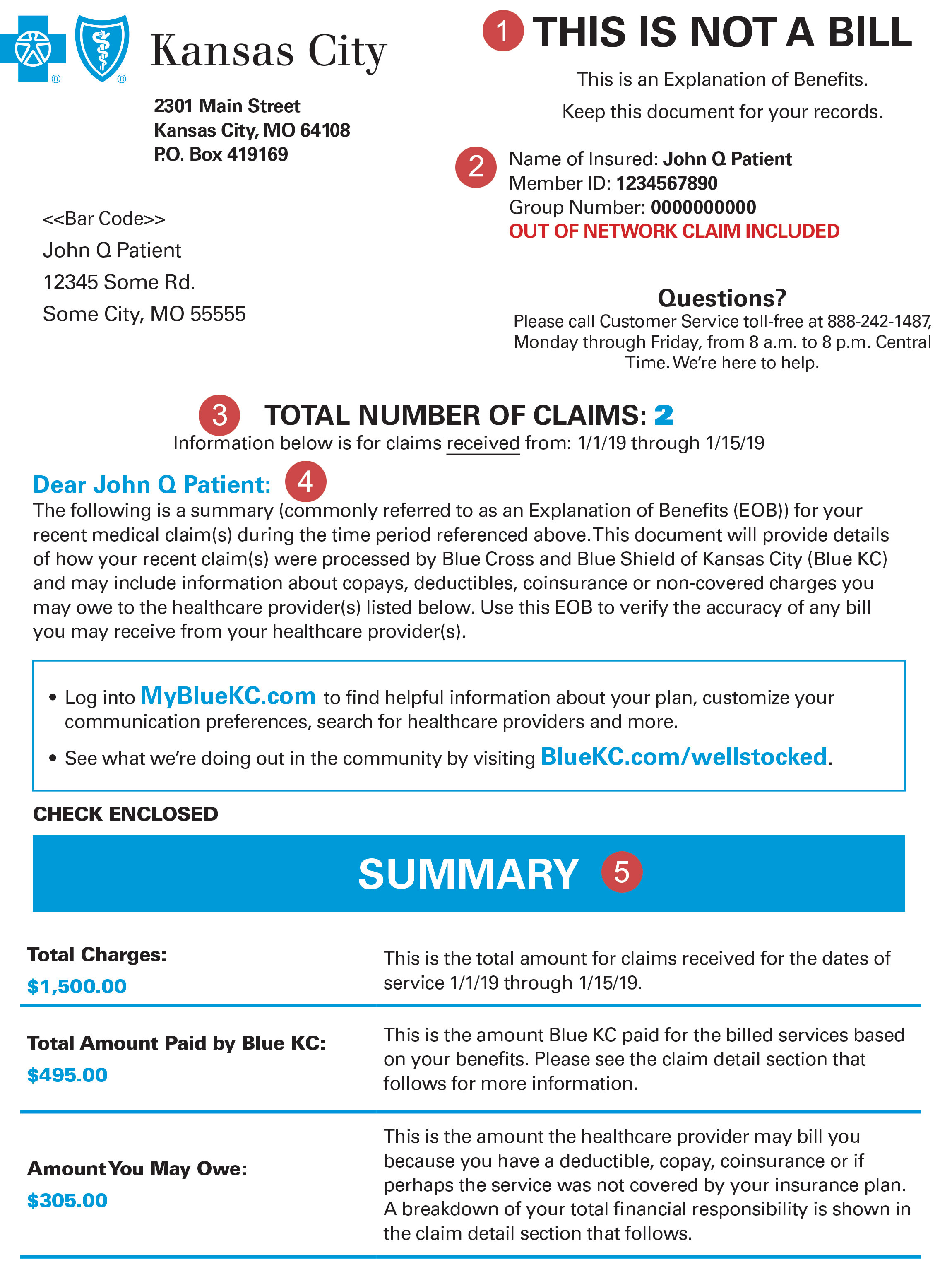

- This is Not a Bill—Your EOB is documentation of how Blue KC has processed your claim. If you do receive a bill from your provider, you can use your EOB to ensure the amount billed is correct based on your Blue KC coverage.

- Member Information—Information about you and your insurance coverage. If an out of network claim has been filed, it is noted here.

- Total Number of Claims—Information about your recent claim(s) within the time period outlined.

- Narrative—A brief overview of how your claim was processed.

- Summary—A simple overview to show how your claim is paid. Please review the Claim Details section for further details.

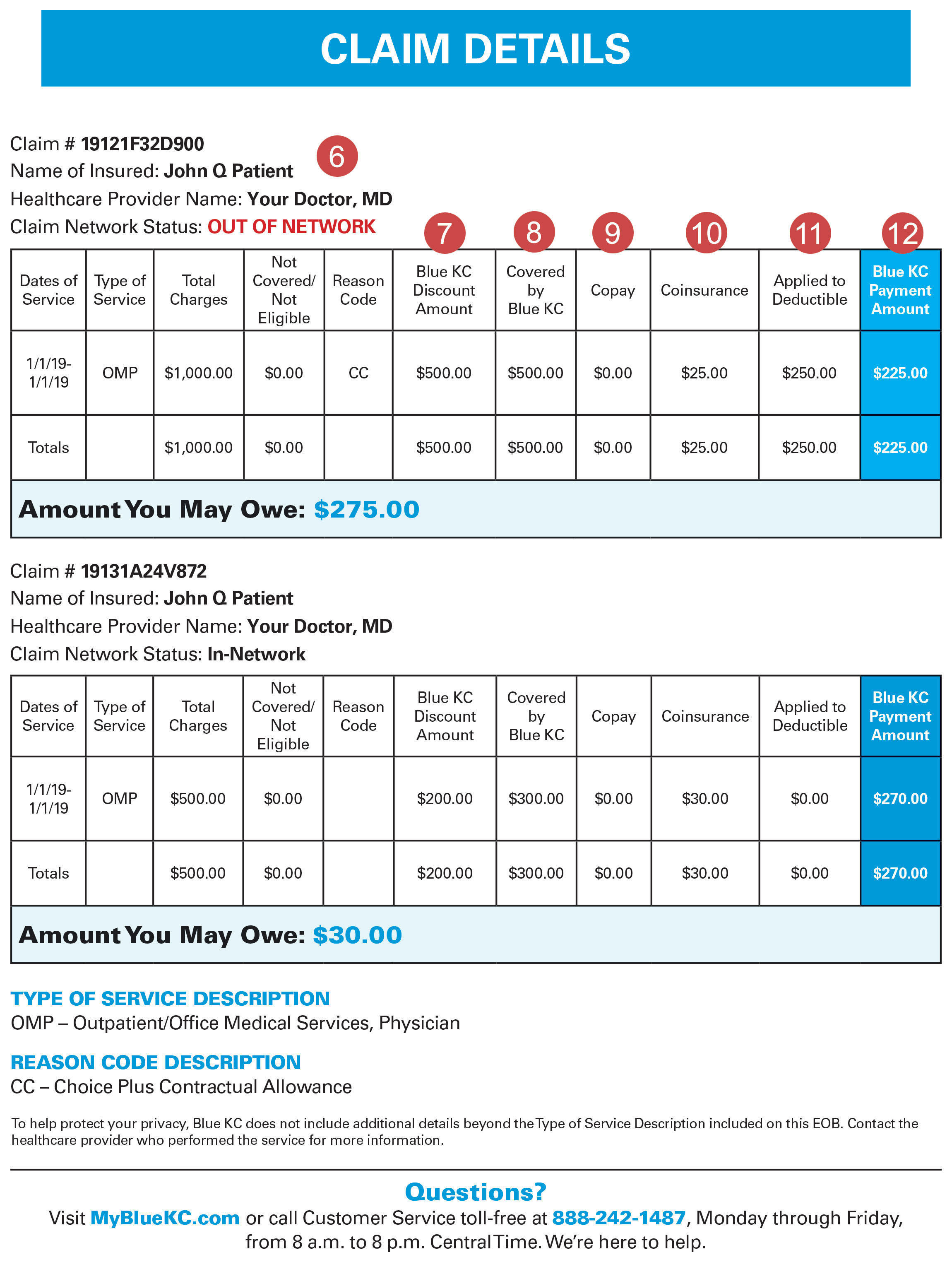

- Claim Details—This area combines critical payment information into one convenient summary. Please review this carefully as it outlines the Blue KC negotiated savings as well as any fees and services for which you are responsible.

- Blue KC Discount Amount—Blue KC has negotiated these savings with providers on your behalf. This is one of the most valuable aspects of having coverage with Blue KC.

- Covered by Blue KC—This is the total of the claim after all discounts and other reductions. Deductible and coinsurance amounts are calculated from this figure.

- Copay—The amount a member must pay each time a specific covered service is received, if your policy includes copayments.

- Coinsurance—The percentage of an allowable charge you must pay for a covered service. Generally, the deductible must be met before your coinsurance applies.

- Applied to Deductible—The portion of the claim being applied to your plan deductible. This amount must be paid by you before benefits become payable by Blue KC.

- Blue KC Payment Amount—This is the amount that Blue KC will pay to the provider or member for the claim.

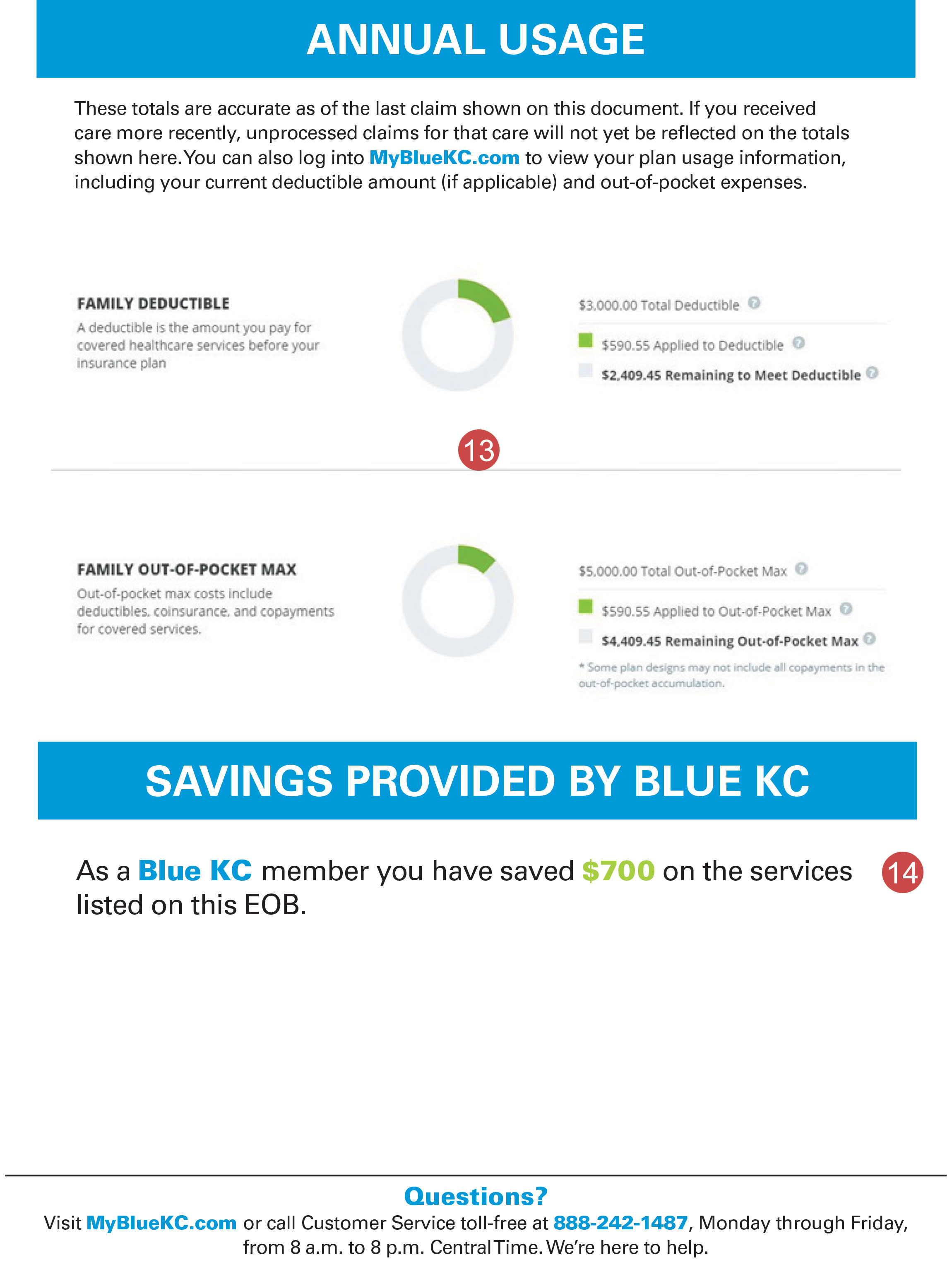

- Annual Usage—This area documents what your deductible status was at the time the claim was processed. Many times, this information will be outdated by the time you receive an EOB. You can get your most recent and up-to-date deductible information by logging into MyBlueKC.com.

- Savings Provided by Blue KC—This is the total amount that you have saved as a Blue KC member on this EOB.

i. Coordination of Benefits (COB):

Coordination of Benefits (COB): Coordinating with another health insurance plan to provide payment for healthcare services for a member who is covered under more than one health insurance contract.